Voice and Viewpoint Newswire

- Covered California joined with African American health experts to promote open enrollment, with new and expanded financial help, and urged Black Californians to get COVID-19 vaccinations and boosters.

- The call to action comes one day before California begins a new statewide mask mandate as COVID infections have increased by nearly 50 percent in the past two-and-a-half weeks.

- An estimated 1.1 million Californians are uninsured and eligible for financial help, with the vast majority able to get coverage at no cost through either Covered California or Medi-Cal.

- New data from Covered California shows the uninsured facing staggering out-of-pocket costs if they visit an emergency room or are admitted into a hospital.

- People who want their coverage to start on Jan. 1, 2022, must sign up by Dec. 31, 2021. Open-enrollment period runs through Jan. 31, 2022.

Covered California joined African American health experts on Tuesday to promote open enrollment while urging Black Californians to answer the call to get COVID-19 vaccinations and boosters, and sign up for comprehensive health insurance coverage through Covered California or Medi-Cal.

“The pandemic continues to hit communities of color in California particularly hard, and we are teaming up with African American health leaders to urge people to not only make sure they have health care coverage, but also to get the COVID-19 vaccinations and boosters,” said Peter V. Lee, executive director of Covered California. “The vaccine is our way to stop COVID-19 and we want to urge everyone, particularly those in the African American community, to get vaccinated to protect themselves, their family and friends.”

More Financial Help Available to More People Than Ever to Enroll in Health Plans

Enrolling now in quality coverage is more affordable — for more people — than ever before thanks to the increased subsidies provided under the American Rescue Plan which took effect earlier this year.

An estimated 1.1 million Californians are uninsured and eligible for financial help. The vast majority of the uninsured, more than 940,000 people, are able to get coverage through either Covered California or Medi-Cal at no cost.

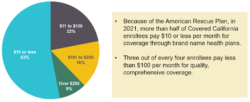

Californians who do not qualify for a $0 premium will still likely see significant savings through the increased financial help available. Right now, more than half of Covered California enrollees are paying less than $10 per month, and 75 percent are paying less than $100 for their brand-name health plan.

Figure 1: More Than Half of Covered California’s Subsidized Enrollees Are Paying Less Than $10 Per Month

“Coverage matters, and the data shows just how much financial protection Covered California’s comprehensive plans are providing,” said Lee. “It’s so important for Californians to take advantage of this major financial help to get enrolled now into affordable, quality health plans to help protect themselves and have the peace of mind that health coverage brings.”

In addition, the American Rescue Plan provides financial help to many families earning more than $106,000 a year. These middle-income families, who were previously ineligible for federal assistance, are now saving an average of nearly $800 a month on their health insurance premiums.

The new financial help for middle-income consumers can also benefit those who are currently insured directly through a health insurance company. An estimated 260,000 Californians have direct coverage — also known as “off-exchange” coverage. They can sign up through Covered California and potentially get the same plan they have off-exchange, or shop for other coverage that best fits their needs and save hundreds of dollars per month.

“Whether you are insured on your own, or you do not have any coverage at all right now, the message is the same: Now is the time to check your eligibility and options,” Lee said. “In just a few minutes you can easily find out how much financial help you can receive, and the coverage options in your area, by visiting CoveredCA.com.”

Community Engagement Key to Increasing Black COVID-19 Vaccination and Booster rates

The latest state data shows that COVID-19 vaccination rates among African Americans currently at 52 percent. Increasing vaccinations and boosters is critical and community engagement is key, says Dr. Kim Rhoads, associate professor of Epidemiology & Biostatistics and the Director of the Office of Community Engagement at UC San Francisco. Dr. Rhoads established the model for the pop-up vaccination clinics in ethnic communities last year, which has become a model in the state.

“Many in healthcare and public health have focused on the importance of building community trust during the pandemic,” said Dr. Kim Rhoads. “What we now know is that trust is critical to getting the vaccine and boosters to California’s most vulnerable populations. But we also know that trust builds at the pace of the relationship.

“Our persistent efforts to increase knowledge about COVID-19 and provide access to resources through our weekly Zoom meetings and in-community, volunteer-based testing, vaccine, and booster events serve to build relationships with these very communities,” Dr. Rhoads said. “One silver lining from the pandemic is that the partnerships we have built and are actively cultivating will create a framework to advance a broader agenda on health equity, that includes linking folks to health care coverage and increasing access to screening and early detection of select cancers.”

Data Shows How Much Plans Cover for Emergency Room and Hospital Visits

Another area of concern among Black Californians is the rising costs of hospital emergency room visits if you don’t have health insurance.

Recent claims data from Covered California enrollees during 2019 and 2020 shows that about one out of ten enrollees visit the emergency room each year and the average overall hospital charge for those visits is $8,000. However, the coverage through Covered California paid for more than 95 percent of those costs, with $375 being the average out-of-pocket cost for their visit.

Similarly, while fewer than 3 percent of Covered California enrollees were admitted to the hospital, the average overall charge for the admission was $43,000, but of those costs, insurance picked up well over 90 percent — leaving enrollees responsible for an average out-of-pocket cost of just $2,700.

Figure 2: Covered California Enrollees Save when Visiting the ER or Hospital

“No one wants to end up in an emergency room or hospital, but if you do, a quality health insurance plan through Covered California can save you tens of thousands of dollars,” Lee said.

“In addition, having health insurance means you are more likely to get preventive care and regular treatment for chronic conditions, which helps keep you out of the hospital in the first place.”

“Having health insurance increases access to doctors and screening tests, which would otherwise be too costly for most of us to pay out of pocket,” said Dr. Justin Britton, emergency physician at Kaiser Permanente Ontario and Fontana medical centers. “Early detection and treatment of diseases like diabetes and hypertension in your doctor’s office can decrease your risk of stroke and heart attack. By the time you come to the ER for neglecting your health, the damage has already been done.”

A recent study by the Kaiser Family Foundation found that more than two out of every five uninsured adults (42 percent) reported that they had not seen a doctor or health care professional in the last 12 months, and 41 percent said they do not have a usual source of care when they are sick or need medical advice. The study also found that nearly one out of every three uninsured either postponed care (32 percent) or went without care (30 percent) because of cost.

“Regardless of where you live, how much you make, what language you speak or what community you’re from, Covered California wants you to get the care you need to stay healthy,” said Dr. Alice Hm Chen, chief medical officer of Covered California. “Covered California plans provide access to some of the best doctors and hospitals across the state and include coverage for both physical and mental health care.”

Mental Health Impacts Due to COVID-19

Mental health crises have increased significantly for Blacks in California since the pandemic began, according to Dr. Curley Bonds, chief medical officer at the Los Angeles County Department of Mental Health.

“African Americans are experiencing a disproportionate burden of mental health issues related to COVID-19, compared to other ethnic and racial groups,” said Dr. Bonds. “Our failure to address structural racism in our society has caused many adverse effects including elevated rates of trauma, anxiety, grief, isolation and emotional distress for Black people.”

“In recent years, Covered California health plans have increased the number of mental health and addiction providers by almost 30 percent, and we will continue working to make sure that when you’re covered, you get the care you need, when you need it,” said Dr Chen.

Free and Confidential Help From Local Enrollers

In addition to signing up consumers through their own through the website, Covered California also partners with certified and licensed enrollers who provide free and confidential help throughout the state. Covered California works with more than 11,000 Licensed Insurance Agents, who have established more than 500 storefronts in communities across California.

These storefronts feature Covered California signs and logos and provide consumers with a local point of contact to answer questions and help people enroll in a health insurance plan that best fits their needs, whether through Covered California or Medi-Cal, depending on their eligibility.

Consumers can visit https://www.coveredca.com/support/contact-us/ and search for the agent or storefront nearest them.

Upcoming Deadline for Jan. 1 Coverage

Covered California’s open-enrollment period runs through Jan. 31, 2022 and those who want their coverage to start on Jan. 1 need to sign up by Dec. 31. Interested consumers can do the following to sign up for coverage:

- Visit CoveredCA.com to learn about their coverage options and enroll online.

- Find a local agent or other certified enroller on the website or have one call them and help them for free.

- Call Covered California at (800) 300-1506 and get information or enroll by phone.

Covered California’s online enrollment portal and certified enrollers will help people find out whether they are eligible for Medi-Cal or Covered California. Medi-Cal enrollment is available year-round, and the coverage will begin the day after a person signs up. In addition, people can apply for Medi-Cal online or by picking up an application at one of the many county resource centers throughout the region.