By Emily Kim Jenkins, Contributing Writer

When a loved one is diagnosed with Alzheimer’s, the world seems to turn all too quickly for those around them. Suddenly, a whirlwind of medical jargon and caregiving needs become intertwined with the emotional trials of watching a friend or family member in cognitive decline. Sometimes, providing care for the individual is a long-distance challenge, something Ron Lewis knows personally.

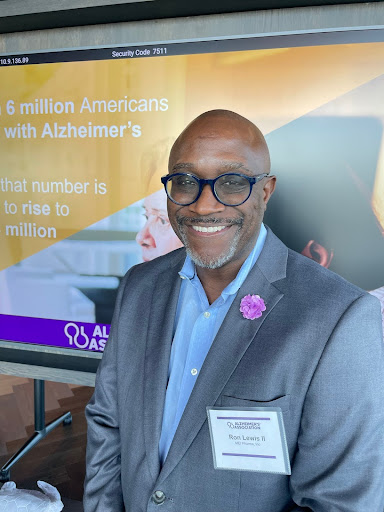

Lewis, the Board Chair for the San Diego/Imperial Valley Alzheimer’s Association, cared for his mother from San Diego after her Alzheimer’s diagnosis while she was in Atlanta. He, like many others involved in Alzheimer’s and dementia advocacy, knows taking on the responsibility of a loved one’s business can be difficult even if there weren’t other challenging emotional circumstances.

Unexpected costs, especially those facing under-resourced communities, can deter or add significant distress to caregivers. The National Institute of Health found that the average annual cost of formal care for an Alzheimer’s patient totals nearly 30 thousand dollars. This financial burden can hit African American communities particularly, since Black adults are nearly twice as likely than White adults to be diagnosed with Alzheimer’s or another age-related dementia. However dismal the figures may seem, there are advocates hard at work to make sure everyone can access financial resources and planning assistance.

“I do see that there is a challenge within our own community to [accept] the situation, also having that fundamental knowledge of what to do, what resources are available to me and [those] who are caring for loved ones who have dementia or Alzheimer’s,” Lewis said. A large part of Lewis’ work with the Alzheimer’s Association was to establish points of connection with underrepresented communities so the association can work towards meeting their needs. He says the most significant challenges in the San Diego area include “access to information, access to adequate medical care, and physicians that are sympathetic, empathetic to our situations, and understand our family dynamics.”

“Currently, it is estimated that 84 thousand persons are living with Alzheimer’s disease in San Diego County, a number that is expected to increase to 117 thousand by 2030,” Assemblymember Marie Waldron’s office wrote to San Diegans on June 11. The office also noted that 250,000 San Diegans are currently caregivers for those suffering from Alzheimer’s.

As a chemist and senior director at MEI Pharma, Lewis’ advice to caregivers from the perspective of someone with both an extensive medical background and someone who has loved an Alzheimer’s patient.

“Take the time to learn as much as you can about the disease. Have the conversation with the primary caregiver and the neurologist, no question is too dumb to ask or too little to ask,” Lewis said. Organization and a fast, pragmatic approach can be helpful in minimizing the pain of a legal or financial disaster later on in a family’s journey, he says. Financial planning for someone else’s accounts is a crucial first step.

“Having those early conversations, gaining family alignment, and mapping out [a financial and legal] plan on all aspects, and the earlier you can do it, the better, and getting the participation and involvement of your loved one in that decision making process, I think, is key,” Lewis said.

Managing someone else’s finances requires a lot of time and knowledge– but fortunately, caregivers are not alone in taking on this responsibility. Experts like estate planners, financial planners and attorneys are all important people to get in touch with, but navigating these preparatory steps can be done alongside others in the same situation and through local organizations. San Diego County’s Aging and Independence Services keeps an updated list of classes, workshops and support resources available throughout the county on their website. The Alzheimer’s Association offers many of these free classes, including an ongoing, free money management course for caregivers, which can all be found on the Financial Planning section of their website.