By Prof. Mark Harris and Tatiana Howell, Special to California Black Media Partners

Financial illiteracy is harming California’s students.

The issue of young people being unprepared for adulthood is often attributed to a lack of financial literacy. However, we believe that the root of the problem lies in the fact that many adults in California are themselves financially illiterate and therefore unable to impart this knowledge to the younger generation.

Assemblymember Kevin McCarty (D-Sacramento) has introduced legislation to address this problem, Assembly Bill (AB) 984. The bill aims to correct this travesty by mandating that instruction on personal finance be integrated into California’s K-12 public schools. AB 984 has the full support of California Superintendent of Public Instruction Tony Thurmond, among many others.

The bill is currently under review in the Assembly Education Committee.

Being financially literate is a crucial skill that everyone should have. It involves understanding and managing personal finances effectively, including skills such as budgeting, saving, investing, managing debt, and comprehending financial products like loans, credit cards, and insurance.

Sadly, many people lack financial literacy. A study conducted by the National Financial Educators Council found that only 24% of American adults have a basic understanding of financial literacy. This lack of knowledge can result in poor financial decisions, leading to debt, and financial instability.

Financial literacy is especially critical for young people. High school students are often ill-prepared to manage their finances when they enter

college or the workforce. Many students take on student loan debt without fully understanding the long-term implications of their borrowing. This lack of knowledge can have lasting consequences, including difficulty repaying loans, damaged credit scores, and limited access to credit in the future.

As a lecturer on the subject, I have had the opportunity to stay connected with many of my former students through social media after they graduated. It’s not uncommon for me to offer them comfort when they discover that a salary close to $100,000 doesn’t stretch as far as they anticipated after accounting for taxes and living expenses. This is without even factoring in the weight of student debt, which cannot be eliminated through bankruptcy and can impact their credit for many years. Unfortunately, this is a harsh reality that catches many students off guard.

According to a recent study conducted by SmartAsset, a person would need to net over $84,000 in annual salary to live “comfortably” in the San Francisco Bay Area. They would need to net $80,000 to live in San Diego or Chula Vista, and almost $77,000 to live comfortably in the Greater Los Angeles area. Those markets would require a person to earn a “pre-tax” annual salary of more than $100,000, which for a recent college graduate, is near impossible.

Financial illiteracy can have far-reaching consequences that extend beyond the individual. When people make uniformed financial decisions, it can have a domino effect on the economy. For example, during the 2008 financial crisis, many people lost their homes due to subprime mortgages, which were offered. This triggered a recession that impacted the economy on a larger scale.

To address this issue, financial literacy education should be a priority in K-12 schools, community colleges, and universities. Students should learn about budgeting, saving, investing, and managing debt. They should also learn about financial products such as credit cards, loans, and insurance. Additionally, they should be taught how to protect their identity and avoid fraud.

Promoting financial literacy education should not be confined to the classroom. Employers can also play a role in educating their employees about managing their finances. Companies can sponsor financial education programs, including workshops and seminars. Additionally, employers can offer access to financial advisors and other resources to help their employees make informed financial decisions.

We hope the California Legislature will adopt AB 984 and forward it to Gov. Gavin Newsom for his signature.

AB 984 will go a long way in correcting this pervasive problem.

____

About the Authors

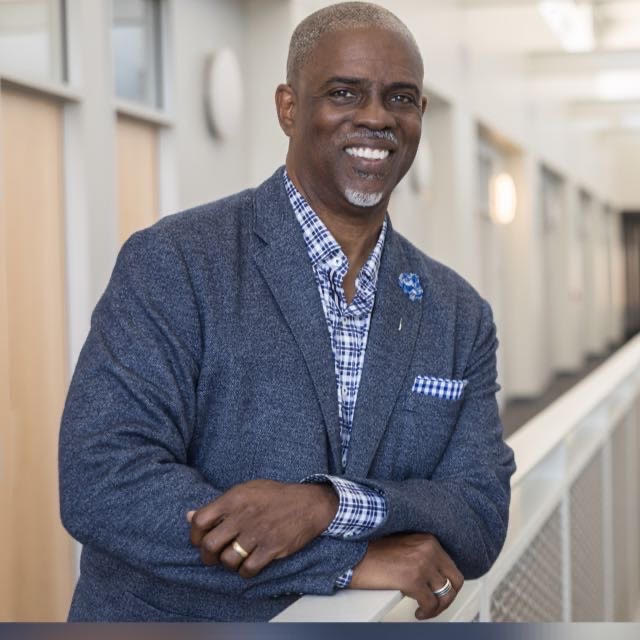

Mark T. Harris, Esq. is a Continuing Lecturer, Management and Business Economics at the University of California, Merced

Tatiana Howell is a junior majoring in Student, Sociology & Management and Business Economics at the University of California, Merced

Mr. Harris served as the Undersecretary for Business, Transportation and Housing under Governor Gray Davis and Deputy Chief of Staff, U.S. Department of Commerce, under The Honorable William Jefferson Clinton. Currently, Professor Harris is on the faculty at the University of California, Merced, where he works alongside his student Ms. Tatiana Howell, who just completed a semester working at the Export-Import Bank in Washington, D.C.