By Macy Meinhardt, Voice & Viewpoint Staff Writer

“No influx whatsoever of any inharmonious influences,” reads a La Jolla real-estate description produced by the Federal Home Owners Loan Corporation dated back to 1935.

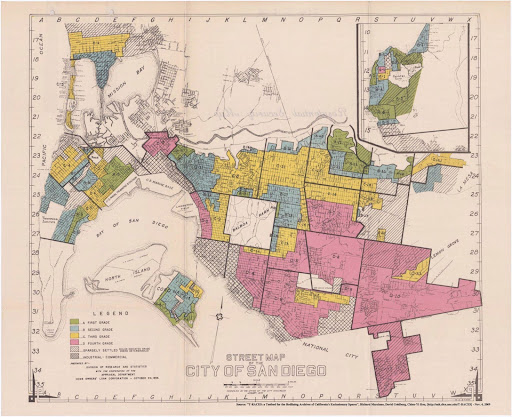

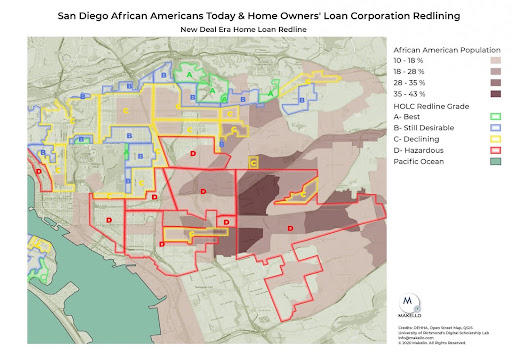

During the mid-1930s, the Federal Home Owners Loan Corporation (HOLC) established neighborhood boundaries based upon resident income levels, race, ethnicity, and housing and land use types. The boundary lines intentionally separated whites from communities of color, pushing the latter into East of Downtown San Diego, (where much of this demographic still lives to this day). Utilizing this data, investment risk grades ranging from A (Best) to D (Hazardous) were assigned to each designated neighborhood that dictated decades of real estate practices in San Diego.

“Residents are 100% white, being composed of retired people, professional and business men and writers” the description goes on to say. The A-grade La Jolla neighborhood was, and still is considered, one of the most exclusive and desired in all of San Diego, according to present day real-estate valuations. Moreso, even eighty-seven-years later, the area is still made up primarily of white-upper class residents.

The link between affluent neighborhoods like La Jolla and predominantly white populations is rooted in the discriminatory practice of redlining. This systematic denial of financial services, based on the arbitrary belief that the presence of racial minorities would lower property values, has historically led to unequal investment, with financial institutions favoring white areas and neglecting Black and Hispanic neighborhoods.

Although outlawed in 1968 by the Fair Housing Act, there is still a lot to unpack when it comes to analyzing redlining and its sustained impact. Luckily however, with over thirty years of advocacy efforts and research on this topic, David G. Oddo’s newest report: My Thirty-Year Effort to Abolish Redlining, other Methods of Mortgage Lending Discrimination, brings a wealth of knowledge on the present day implications of redlining and how it has gone on to define the socioeconomic makeup of many San Diego neighborhoods today.

When asked what are the most surprising patterns that have emerged from Oddo’s decades of research, he says that it’s “just how little things have changed,” from when he started in the late 70’s to now. Despite being a city that champions diversity and exclusivity more than ever before, continued segregation of housing by race, ethnicity, and income still runs rampant today.

“As cities across the nation are being forced to examine how and where structural racism manifests locally, redlining is often the first stop,” according to the Local Initiatives Support Corporation, an organization that has also served as a front runner in the local research on redlining.

Furthermore, one of Oddo’s findings from the San Diego Reinvestment Task Force shows that in 2022, five large banks operating in San Diego County invested only 2.6% of their local deposit base to local low and moderate income neighborhoods. The number has hardly changed since 1977 which was documented at 2%. According to reports from the The San Diego Union, (known today as the The San Diego Union Tribune): “The fewest dollars were loaned in the downtown area and in areas the government defined as predominantly Black, poor white or Mexican-American,” the Union report reads. Whereas the other 98% of funds go elsewhere in the area such as La Jolla and other more prosperous suburbs.

Not only does this impact the quality of these segregated neighborhoods as seen in their parks, libraries and schools, it also further explains why there is a disparity in home ownership amongst Blacks and Latinos versus Caucausian home buyers, despite income or credit worthiness. In San Diego County, the home ownership rate was 61% for white households, 35% for Hispanic and Latino households, and 31% for African American households, according to data from The State of The Nations Housing 2022.

In addition, Oddo’s report also pieces together evidence on how San Diego’s African American community suffers from mortgage lending discrimination—which can also point to the lack of home ownership amongst marginalized demographic groups .

“Mortgage lending discrimination occurs when equally qualified individuals are treated differently due to their race or ethnicity,” Oddo’s report reads. Labeled as a form of redlining, findings from the National Association of Real Estate Brokers show that “Black borrowers relied on high-cost home loans nearly three times more often; 14 percent of Black borrowers in 2021 took out high-cost loans versus 5 percent of white borrowers”. Furthermore, in 2022 African Americans nationwide were denied home purchase loans two-and-one half times more frequently than white, non hispanic applicants.

As a result, by barring specific demographic focused neighborhoods from home ownership services, Black and Latino San Diegans have historically been excluded from the chance to build multi generational wealth through real estate ownership. Which has ultimately contributed to crystallized effects of racism and segregation we see in our San Diego neighborhoods today.

Stay tuned in future weeks for more about David Oddo and his research on the practice of redlining in San Diego and nationwide. For inquiries on his work, he can be reached by email at: [email protected]