By Edward Henderson, California Black Media

On June 11, Vice President Kamala Harris and Consumer Financial Protection Bureau Director (CFPB) Rohit Chopra announced that the Biden administration has established a new federal rule that removes medical debt from the credit reports of nearly 15 million Americans. The rule also bans reporting agencies from factoring that debt into credit scores.

“We are making it so that medical debt cannot be used against you when you apply for a car loan, a home loan, or a small-business loan,” said the Vice President.

“Millions of Americans will see an increase in their credit score, on average, of 20 points, which will mean every year an estimated 22,000 more American families will be approved for a mortgage and able to buy a home,” she added. Video: What you can do about your medical debt?

On June 26, the Los Angeles County Board of Supervisors approved a $5 million pilot program to eliminate up to $500 million in medical debt owed by an estimated 150,000 residents. The funds will be used for an agreement with Undue Medical Debt, a non-profit organization that buys unpaid debt at a fraction of its original cost and absolves it. The effort is expected to launch later this year. The initiative, authored by Supervisors Holly Mitchell and Janice Hahn, intends to eventually buy a total of $2.9 billion in medical debt, impacting some 800,000 L.A. County residents.

The federal government and Los Angeles County are not alone in trying to find permanent solutions to the worrisome problem of medical debt. Policymakers and advocates in California and around the country have been proposing a range of solutions to address the escalating problem of medical debt, which burdens people at all income levels, but falls especially hard on middle-class Black people.

In 2020, nearly 23.5% of Americans earning between $50,000 and $100,000 had medical debt that they could not afford to pay according to a study by Third Way, a Washington-D.C.-based think tank.

For African Americans, the numbers are particularly concerning. About 38% of Black Americans have accrued medical debt they can’t afford to pay.

“Medical debt is more than a financial burden; it is a profound health crisis that disproportionately impacts Black Californians, stripping them of economic security and mental peace, perpetuating a cycle of economic insecurity and health disparities in communities already vulnerable,” states Kellie Todd Griffin, President & CEO of California Black Women’s Collective Empowerment Institute.

Why do Black people have so much more medical debt than their White peers? Researchers from the National Consumer Law Center point to both the racial wealth gap and the racial health gap. In their 2022 report on medical debt, they found that “racial inequality underlies these disparities in medical debt.” Without equal opportunities to earn, save and build wealth through homeownership, Black people are less able to pay their medical bills, which leaves them unable to get medical care. This leads to a spiral of debt and poor health.”

According to the California Reparations Report, in 2019, the median African American household had a net worth of $24,100 as compared to the median net worth of white households of $188,200.

According to the report, “This wealth gap persists regardless of education level and family structure.”

Consider the case of Bethany Harris, a Black, middle-class resident of San Diego.

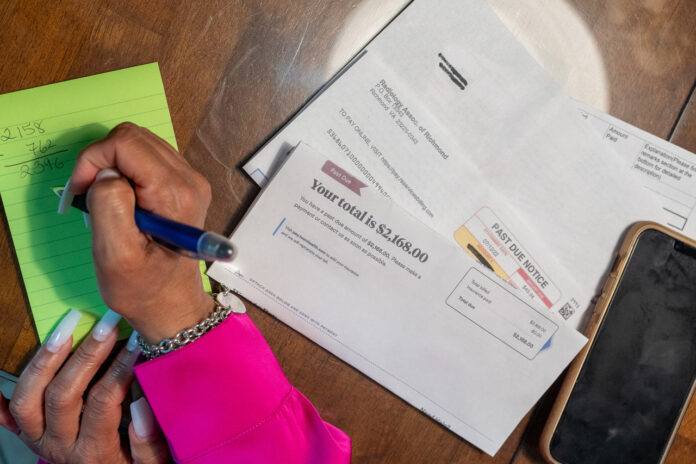

When excruciating back pain drove Harris to seek medical attention, she had no idea that doctors would admit her and recommend gallbladder surgery. She ended up spending three days in the hospital.

Despite having a stable professional job and employer-provided health, Harris was shocked to receive a $4,500 co-pay for her initial care and tests. A year later, the surgery added another $6,500 in co-pay responsibility.

“The co-pay is ridiculous,” Harris told California Black Media. I have been spending all this money out of my paycheck for 20 years for insurance. I barely use it outside of annual physicals and eyeglasses. It’s crazy, there is no way I can afford this stuff.”

For middle-class Black Californians like Harris, their income level often disqualifies them from most institutional discounts, government financial assistance, and nonprofit assistance.

Rhonda Smith, Executive Director of the California Black Health Network (CBHN), told California Black Media, “People with medical debt absolutely have rights.”

“California requires hospitals to provide financial aid to patients.” Download your hospital’s financial aid policy. You can get the policies and applications in the state on the California Department of Health Access and Information (HCAI) website.”

Dr. Naman Shah is a family physician and epidemiologist at the LA Department of Public Health, where he is Director for the Division of Medical and Dental Affairs.

Shah mentioned some of the other pitfalls that can plunge individuals further into debt, including medical credit cards and dubious or unclear billing methods employed by some hospitals. In addition, debt collections agencies will apply unscrupulous methods and, according to a study by ProPublica, disproportionately target Black communities.

A range of policies and programs to address medical debt are in motion across the country and here in California. In January 2024, New York City Mayor Eric Adams approved $18 million to purchase the medical debt of 500,000 New Yorkers, saving them up to $2 billion.

In March, state Attorney General Rob Bonta, Senator Monique Limón (D- Santa Barbara), and a coalition of prominent consumer advocacy organizations unveiled Senate Bill 1061 (SB 1061), legislation seeking to protect the financial security of Californians by prohibiting medical debt from being listed on credit reports.

Before Harris announced the White House rule, U.S. Senators Bernie Sanders (D-VT.) and Jeff Merkley (D-OR.) and U.S. Rep. Ro Khanna (D-CA-17) introduced legislation in May to cancel some $220 billion in medical debt owed by Americans across the country.

“This is the United States of America, the richest country in the history of the world. People in our country should not be going bankrupt because they got cancer and could not afford to pay their medical bills,” said Sanders. “The time has come to cancel all medical debt and guarantee health care to all as a human right, not a privilege.”