By Stacy M. Brown, NNPA Newswire Senior National Correspondent

As the Trump administration prepares to close out its first full month back in power, the fears many Americans expressed about Project 2025 are rapidly becoming frightening realities. House Republicans unveiled a budget resolution on Wednesday that slashes federal spending by $2 trillion while providing up to $4.5 trillion in tax cuts—largely benefiting the wealthy and major corporations. The budget, introduced by House Budget Committee Chairman Jodey Arrington, sets the stage for a massive GOP-led legislative push to pass President Donald Trump’s economic agenda. If the committee and the full House approve, Republicans could move forward with a party-line reconciliation bill that would bypass Senate filibuster rules and enact sweeping tax and spending changes.

At the heart of the plan is the dramatic redistribution of resources, cutting programs that millions of Americans rely on while extending tax breaks for the richest households and businesses. The resolution grants $110 billion for border security and immigration enforcement, significantly less than the $175 billion allocated in the Senate’s version. Meanwhile, it raises the debt limit by $4 trillion in anticipation of a looming deadline later this year that could force Congress to act or risk defaulting on the nation’s obligations.

Deep Cuts to Healthcare, Food Assistance, and Education

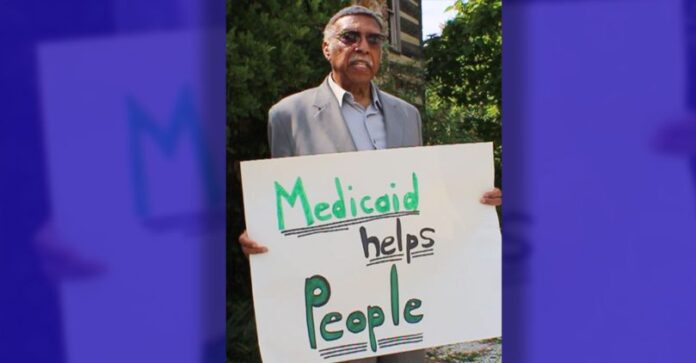

The budget’s reconciliation instructions call for slashing $2 trillion in mandatory spending—a category that includes Medicare, Medicaid, the Supplemental Nutrition Assistance Program (SNAP), and other essential safety-net programs. If lawmakers fail to achieve those cuts, the resolution mandates a proportional reduction in tax cuts. However, House conservatives have already demanded even steeper spending reductions. The Center on Budget and Policy Priorities described the proposal as “an extreme giveaway to the wealthy at the expense of families who already have a hard time making ends meet.” The nonpartisan research group warned that the GOP plan would increase healthcare costs, make college more expensive, deepen economic inequality, and exacerbate poverty for tens of millions of Americans.

“For weeks, House Republicans have been circulating proposals that would take health coverage and food assistance away from millions of people and raise the cost of student loans to offset part of the cost of extending the expiring 2017 tax cuts,” officials at the center stated. “More than 36 million people could lose Medicaid coverage, over 40 million could see reductions in SNAP benefits, and millions of students may face higher borrowing costs to pay for college.” These proposals would have devastating real-world consequences. For families dependent on Medicaid, it could mean the inability to afford cancer treatments, insulin for diabetes, or basic medical care. Cuts to food assistance would force parents to skip meals so their children can eat. Those in rural communities and communities of color, who already face higher poverty rates, would be hit especially hard.

Additionally, the GOP budget could shift enormous costs to state, local, and tribal governments, already experiencing financial strain. Many of these governments would be unable to cover the gaps, leading to more severe economic consequences for low-income Americans.

Tax Breaks for the Wealthy While Millions Struggle

The spending cuts outlined in the resolution mirror the priorities of Project 2025, the right-wing policy blueprint crafted by the Heritage Foundation. While Trump distanced himself from the plan on the campaign trail, its core elements are now being pushed through Congress. One of the most alarming aspects is the proposal to impose lifetime caps on Medicaid benefits, which could leave millions without health coverage. The budget’s tax cuts overwhelmingly benefit the wealthiest Americans. The plan seeks to extend the expiring 2017 tax cuts for another decade, adding trillions to the deficit. Households earning over $743,000 per year, the top 1%—would receive an average tax break of $62,000 annually. Meanwhile, working-class Americans would see higher healthcare, education, and food costs.

Despite prioritizing tax relief for the ultra-rich, the budget proposal fails to extend the Affordable Care Act’s premium tax credits, which have helped 20 million Americans afford health insurance since 2021. If these credits expire, premiums will skyrocket for millions, including at least 3 million small business owners and self-employed workers. The Food Research and Action Center has also raised alarms about the proposal’s drastic changes to food assistance programs. The budget seeks to impose harsher work requirements for non-disabled adults without dependents and eliminate state flexibility in determining food stamp eligibility. Additionally, it aims to roll back updates to the Thrifty Food Plan, which modernized the SNAP benefits formula after decades of being outdated.

Republicans Push Forward Despite Widespread Opposition

The House GOP’s budget resolution now heads to the Budget Committee, where Republicans will need a majority vote to advance it to the full House. With a razor-thin majority of 218-215, they have little room for defections. The measure is unlikely to receive any Democratic support. Senate Republicans are also moving forward with their version of the budget, which includes more funding for border security. Sen. Lindsey Graham, R-S.C., criticized House Republicans for cutting immigration enforcement funding to $110 billion instead of the $175 billion requested by Trump’s border czar Tom Homan. “They’re not listening to the administration as to what they need,” Graham said. “Now is not the time to go on the cheap to secure the border.”

Meanwhile, Democrats have blasted the GOP plan as a blatant attack on working-class Americans. “Republicans are pulling a fast one on working people by reaching into their pockets to pay for billionaire handouts,” said Sen. Elizabeth Warren, D-Mass. “Make no mistake: this GOP plan will raise the cost that American families pay for groceries, health care, and getting an education—all to fund tax cuts for the ultra-rich.” Rep. Brendan Boyle, D-Pa., the ranking Democrat on the Budget Committee, warned that the Republican proposal would drive up the national debt while making life harder for middle-class families. “This Republican plan isn’t just bad policy—it betrays the middle class,” Boyle said. “Their proposal slashes critical programs that millions of hardworking Americans rely on, all while adding trillions of dollars to the deficit to bankroll massive giveaways for giant corporations and billionaires like Elon Musk.”