Exclusive to San Diego Voice & Viewpoint

By Tanu Henry | California Black Media

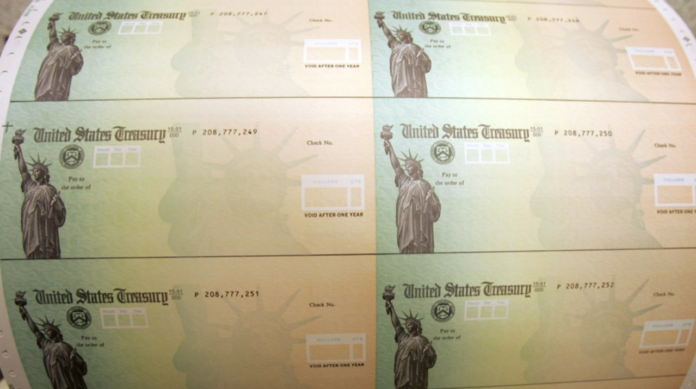

The federal government has approved $2 trillion dollars as well to aid states in their efforts to respond to the COVID-19 crisis. The money will help people, businesses and non-profits impacted; and to pay for government programs related to the pandemic.

Two weeks ago, after Gov. Newsom issued a state of emergency in California, the legislature wrote a $1 billion blank check to the state, giving it broad authority to spend the money “for any purpose” related to the Coronavirus crisis.

“By our back-of-the-envelope estimate, as we process more of the details of the stimulus bill, the state of California will be the beneficiary of over $10 billion just in the state block grant portion,” Gov. Newsom revealed in a press conference last week.

He said $5.5 billion of that federal money will go to the state itself and the rest will be pushed down to cities and counties.

California Black Media will be following the money, letting you know what programs at the federal, state, county and city level could benefit you.

For now, here are eight things Californians should know about programs that impact your life and money.

Most Singles Will Soon Receive a Payment of $1200; Married Couples, $2400

Most individuals with a social security number in the United States will receive a one-time payment of $1200. To qualify, you would have to earn an adjusted gross income of $75,000 annually or less. For singles earning above $75,000, the payout will decrease on a scale up to $99,000.

Individuals who file taxes as head of household and earn less than $112,500 qualify for the $1,200 payment as well.

Married couples with no children who earn $150,000 or less will receive $2400. Above that, that payment will reduce on a sliding scale up to $198,000.

People with children under age 16 will receive an additional $500 per child. Families with two children who earn above $218,000 will not qualify for the payments.

All Californians Are Protected From Evictions

Two weeks ago, Gov. Newsom issued an executive order giving local governments the authority to halt evictions across the state, but his order, at the time, did not prohibit them.

The governor said, “people shouldn’t lose or be forced out of their home because of the spread of COVID-19.”

Then, this week, the governor lifted the burden off distressed renters in California even more when he established a statewide moratorium on evictions.

Under the new rules, the tenant would be required to retain documentation and will also be responsible to “repay the full rent in a timely manner and could face eviction after the moratorium is lifted.”

The U.S. Department of Housing and Urban Development has also placed an eviction moratorium on all Section 8 and other federally subsidized properties across the country.

Most Californians Don’t Have to Worry About Mortgage Fees or Foreclosures

Gov. Newsom announced last week that the state has struck a deal with a number of major financial institutions, including Citigroup, JP Morgan Chase, US Bank, Wells Fargo, Bank of America and nearly 200 state-chartered banks, credit unions, and other loan firms. They have all agreed to provide temporary relief for homeowners in the state.

Bank of America was the only major financial institution that did not commit to the program for 90 days, opting to help homeowners for only 30 days. After pressure from Gov. Newsom and their customers, the bank has now signed on for the full 90-day period.

Homeowners may still have to apply to activate the benefits.

The mortgage relief programs include: a 90-day grace period on all mortgage payments; a new streamlined process to request forbearances; no new foreclosures for 60 days; no fees and charges for 90 days (including late payment fees); no credit score reporting for 90 days; and no credit score penalties for participating in the programs.

The federal government has also put a moratorium on foreclosures on all federally-backed housing loans.

Children Can Get Free Lunches, WiFi Hotspots and Discounted Internet

California public schools will remain fully funded.

That means kids can continue to get free lunches at school. Contact your local school district to get more details about the program.

The state has also provided guidance on distance learning for parents.

And utility companies — including the AT&T, Comcast and Spectrum Mobile — have set up WiFi hotspots for students to use and they all offer discounted monthly rates to low-income families for around $10 a month.

Laid-Off Californians Will Receive An Additional $600 a Week From the Feds

If you lose your job in California due to the COVID-19 crisis, you are entitled to unemployment insurance, which, depending on your last salary, ranges from $40 to $450 for 26 weeks.

During this crisis, the federal government has approved an additional $600 a week payment for a period of four months for individuals who have lost or will lose their jobs due to the global pandemic.

Both the federal government and the state of California have extended unemployment benefits to include independent contractors and other gig workers.

You Don’t Have to Lose Your Job to Get Unemployment Benefits

During the state of emergency, Californians who are furloughed or quarantined without pay and expect to go back to their jobs may qualify for unemployment payments.

Your Phone, Lights, Water and Utilities Will Not Be Disconnected

The California Public Utilities Commission has instructed all energy, water, sewer and communications companies to stop all disconnections.

You Can Pause Your Student Loan Payments

The U.S. Department of Education has granted Americans who owe student loans a 60-day payment waiver.

“All borrowers with federally held student loans will automatically have their interest rates set to 0 % for a period of at least 60 days,” stated a U.S. Department of Education press release. “In addition, each of these borrowers will have the option to suspend their payments for at least two months to allow them greater flexibility during the national emergency. This will allow borrowers to temporarily stop their payments without worrying about accruing interest.”

Borrowers will still have to contact their loan servicers to request the waiver or to find out if their student loan debts are eligible for the program.

Although the programs do not apply to private lenders, several of those institutions, including Sallie Mae, have agreed to suspend the monthly payments as well.